Archive for March 13th, 2009

Another take on the financial value of open source

Posted by cdaffara in OSS business models, OSS data on March 13th, 2009

The “real” value of open source in financial terms has been one of my favourite arguments, and I had the opportunity to research in this area for a long time, thanks to our work for the customers for which we provide consulting on OSS business models. I recently found a new post on this by Bruno Von Rotz, with some preliminary conclusions like “total value of USD 100 to 150 billion.. I would assume that some of it comes from enterprises and large organizations, but this is probably max 20-30% of it.”

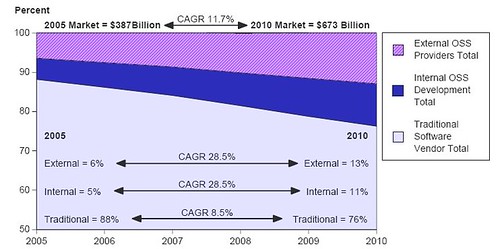

I would like to provide first of all a validation of the first part, and a comment on the second. As for the software market, Gartner published in 2006 a very well done study on OSS in the context of the overall software market, and among the various results there is one that I found quite interesting:

Considering the fact that some parallel data points (like results from the OECD estimates on software market) more or less confirm the predictions from Gartner, we can say that OSS has a financial value of 120B$ now, and will reach 150B$ in 2010, perfectly in line with the predictions from Bruno.

What I am not convinced is the calculation of the share 0f voluntary contributions Vs. company contributions. If Gartner data is accurate (and I believe that this is the case) we can expect that companies should contribute between 40% and 50% of value to a project; and this is somewhat consistent with projects like Linux or Eclipse where there is a large ecosystem, not only of adopters but of commercial companies working on top, and where company contributions are in that range. In this sense, I believe the 20%-30% percentage mentioned by Bruno to be too restrictive; the problem is that measuring code is not the only way to measure contributions. I use frequently this as an example:

“In the year 2000, fifty outside contributors to Open Cascade provided various kinds of assistance: transferring software to other systems (IRIX 64 bits, Alpha OSF), correcting defects (memory leaks…) and translating the tutorial into Spanish, etc. Currently, there are seventy active contributors and the objective is to reach one hundred. These outside contributions are significant. Open Cascade estimates that they represent about 20 % of the value of the software.”

Do these contributions appear as source code? No, exactly as localization efforts for OpenOffice or KDE do not appear in source code metrics. My belief is that the value of OSS right now is even much larger than 120B$, and that we have simply no way to measure this “hidden” value- but it’s there.

Our definitions of OSS-based business models

Posted by cdaffara in OSS business models, OSS data on March 13th, 2009

Two days ago, Matthew Aslett was so kind to comment on our new research on OSS business models; especially our new taxonomy, based on our latest extensions of the FLOSSMETRICS methodology and the increase in the number of surveyed companies. We both share the interest in having a clear, simple and usable set of definitions to avoid confusion when referring to specific business models; and he decided to publish the (previously private) set of definitions that were adopted in the CAOS report “Open source is not a business model“. As I would like to find a converging set of definitions, I will publish here a pre-release of our next edition of the OSS guide, that covers in more detail what Lampitt classify as “vendor licensing strategy”. My hope is to see if it is possible to find an agreed-to definition, that can be shared by researchers and experts. As already mentioned in my previous post, we introduced several changes compared to the previous edition:

- It does, for the first time, disaggregate what was originally called ITSC (Installation, training, support, consulting) because many successful companies are now specializing in a single activity. This is a significant change from 2006 (when we started collecting data on OSS models), when companies were performing in a more or less undifferentiated way all those activities. We believe that this “specialization” will continue with the enlargement of the commercial OSS market.

- We removed the “badgeware” category from the list. We found that some of the vendors that originally followed this model disappeared, and for those remaining protection from freeriding and overall model was more or less morphed into a “open core” or “split oss/commercial”. As the visibility clause can now be included in the GPLv3, I believe that the remaining few badgeware licenses will disappear quickly.

- As for our missing model (proprietary built on open) we found that basically the majority of products use OSS inside, so we are waiting to finish our second strand of research, on how to separate those products that are entirely OSS based from those that merely “use” OSS; our current idea is related to the “substitution principle”: is it possible to market the same product when all OSS components are substituted by non-OSS ones? Does it falls in the same market, or it becomes something radically different? This is a common theme, that tries to answer questions like “would it have been possible for Google to be based on proprietary software?”

Taking this into consideration, here is our new taxonomy:

- Dual licensing: the same software code distributed under the GPL and a commercial license. This model is mainly used by producers of developer-oriented tools and software, and works thanks to the strong coupling clause of the GPL, that requires derivative works or software directly linked to be covered under the same license. Companies not willing to release their own software under the GPL can buy a commercial license that is in a sense an exception to the binding clause; by those that value the “free as in speech” idea of free/libre software this is seen as a good compromise between helping those that abide to the GPL and receive the software for free (and make their software available as FLOSS) and benefiting through the commercial license for those that want to maintain the code proprietary. The downside of dual licensing is that external contributors must accept the same licensing regime, and this has been shown to reduce the volume of external contributions (that becomes mainly limited to bug fixes and small additions).

- Open Core (previously called split OSS/commercial): this model distinguish between a basic FLOSS software and a commercial version, based on the libre one but with the addition of proprietary plugins. Most companies adopt as license the Mozilla Public License, as it allows explicitly this form of intermixing, and allows for much greater participation from external contributions, as no acceptance of double licensing is required. The model has the intrinsic downside that the FLOSS product must be valuable to be attractive for the users, but must also be not complete enough to prevent competition with the commercial one. This balance is difficult to achieve and maintain over time; also, if the software is of large interest, developers may try to complete the missing functionality in a purely open source way, thus reducing the attractiveness of the commercial version.

- Product specialists: companies that created, or maintain a specific software project, and use a pure FLOSS license to distribute it. The main revenues are provided from services like training and consulting (the “ITSC” class) and follow the original “best code here” and “best knowledge here” of the original EUWG classification. It is based on the assumption, commonly held, that the most knowledgeable experts on a software are those that have developed it, and this way can provide services with a limited marketing effort, by leveraging the free redistribution of the code. The downside of the model is that there is a limited barrier of entry for potential competitors, as the only investment that is needed is in the acquisition of specific skills and expertise on the software itself.

- Platform providers: companies that provide selection, support, integration and services on a set of projects, collectively forming a tested and verified platform. In this sense, even Linux distributions were classified as platforms; the interesting observation is that those distributions are licensed for a significant part under pure FLOSS licenses to maximize external contributions, and leverage copyright protection to prevent outright copying but not “cloning” (the removal of copyrighted material like logos and trademark to create a new product). The main value proposition comes in the form of guaranteed quality, stability and reliability, and the certainty of support for business critical applications.

- Selection/consulting companies: companies in this class are not strictly developers, but provide consulting and selection/evaluation services on a wide range of project, in a way that is close to the analyst role. These companies tend to have very limited impact on the FLOSS communities, as the evaluation results and the evaluation process are usually a proprietary asset.

- Aggregate support providers: companies that provide a one-stop support on several separate OSS products, usually by directly employing developers or forwarding support requests to second-stage product specialists.

- Legal certification and consulting: these companies do not provide any specific code activity, but provide support in checking license compliance, sometimes also providing coverage and insurance for legal attacks; some companies employ tools for verify that code is not improperly reused across company boundaries or in an improper way.

- Training and documentation: companies that offer courses, online and physical training, additional documentation or manuals. This is usually offered as part of a support contract, but recently several large scale training center networks started offering OSS-specific courses.

- R&D cost sharing: A company or organization may need a new or improved version of a software package, and fund some consultant or software manufacturer to do the work. Later on, the resulting software is redistributed as open source to take advantage of the large pool of skilled developers who can debug and improve it. A good example is the Maemo platform, used by Nokia in its Mobile Internet Devices (like the N810); within Maemo, only 7.5% of the code is proprietary, with a reduction in costs estimated in 228M$ (and a reduction in time-to-market of one year). Another example is the Eclipse ecosystem, an integrated development environment (IDE) originally open sourced by IBM and later managed by the Eclipse Foundation. Many companies adopted Eclipse as a basis for their own product, and this way reduced the overall cost of creating a software product that provides in some way developer-oriented functionalities. There is a large number of companies, universities and individual that participate in the Eclipse ecosystem; as an example:

As recently measured, IBM contributes for around 46% of the project, with individuals accounting for 25%, and a large number of companies like Oracle, Borland, Actuate and many others with percentages that go from 1 to 7%. This is similar to the results obtained from analysis of the Linux kernel, and show that when there is an healthy and large ecosystem the shared work reduces engineering cost significantly; Gosh estimates that it is possible to obtain savings in terms of software research and development of 36% through the use of FLOSS; this is, in itself, the largest actual “market” for FLOSS, as demonstrated by the fact that the majority of developers are using at least some open source software within their own code.

As recently measured, IBM contributes for around 46% of the project, with individuals accounting for 25%, and a large number of companies like Oracle, Borland, Actuate and many others with percentages that go from 1 to 7%. This is similar to the results obtained from analysis of the Linux kernel, and show that when there is an healthy and large ecosystem the shared work reduces engineering cost significantly; Gosh estimates that it is possible to obtain savings in terms of software research and development of 36% through the use of FLOSS; this is, in itself, the largest actual “market” for FLOSS, as demonstrated by the fact that the majority of developers are using at least some open source software within their own code. - Indirect revenues: A company may decide to fund open source software projects if those projects can create a significant revenue source for related products, not directly connected with source code or software. One of the most common cases is the writing of software needed to run hardware, for instance, operating system drivers for specific hardware. In fact, many hardware manufacturers are already distributing gratis software drivers. Some of them are already distributing some of their drivers (specially those for the Linux kernel) as open source software.

The loss-leader is a traditional commercial model, common also outside of the world of software; in this model, effort is invested in an open source project to create or extend another market under different conditions. For example, hardware vendors invest in the development of software drivers for open source operating systems (like Linux) to extend the market of the hardware itself. Other ancillary models are for example those of the Mozilla foundation, that obtains a non trivial amount of money from a search engine partnership with Google (an estimated 72M$ in 2006), while SourceForge/OSTG receives the majority of revenues from ecommerce sales of the affiliate ThinkGeek site.

At the moment there is no “significant” model, with companies more or less adopting and changing model depending on the specific market or the shifting costs. For example, during the last few years a large number of companies shifted from an “open core” model to a pure “product specialist” one to leverage the external community of contributors. Many researchers are trying to identify whether there is a more “efficient” model among all those surveyed; what we found is that the most probable future outcome will be a continuous shift across model, with a long-term consolidation of development consortia (like Symbian and Eclipse) that provide strong legal infrastructure and development advantages, and product specialists that provide vertical offerings for specific markets.